Mother Jones Magazine, a progressive investigative paper around since the 1970s, had done an interesting, though to me frightening, bit of research about the average household income from 1979 to 2007 in America. The obvious thing was that the rich in the USA had the vast majority of the wealth, something that has been found in previous research for some time. Hardly shocking, and because it has become so commonplace it hardly moves anyone to action except the most liberal.

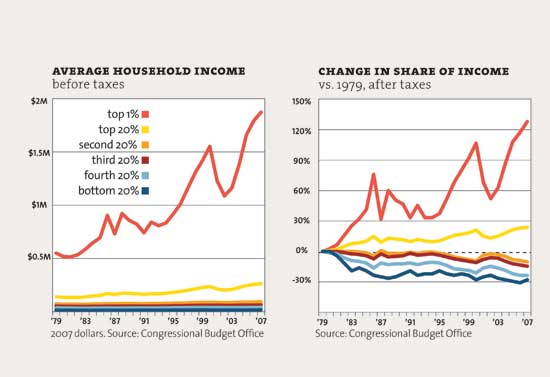

The graph that really caught my attention though was this:

As can be seen, the growth income for the bottom 80% of the country was non-existent for about three decades, and after taxes it was negative. Conversely, the top 20% made money, even after taxes, and the top 1% more than doubled their income. It is also interesting that there appears to be a correlation between when the rich take a hit and when the lower income levels go up, but without actually analyzing the raw data I can't say if this is statistically significant--that is, a real result or an artifact of my eye.

I can't think of better data that disproves the supply-side economics slogan that rising waters lifts all boats. When 80% of a country can get poorer while the GDP grew on average throughout this same period, that is a model worth setting out to sea.

On the other hand, there are empirical facts that show that income disparities actually hurt economies. This has been shown by researchers Roberto Perotti (“Growth, Income Distribution, and Democracy: What the Data Say”, Journal of Economic Growth 1(2) (1996): 149-187) and some at the World Institute for Development Economics Research. The same research also finds that high equality rates can be damaging as well, which explains by communist systems have been historically problematic.

What this means is that the current model of giving more tax breaks to the top 1% in this country is not going to bring salvation but only exacerbate the problem. Besides, if the poor keep getting poorer, then they cannot afford the products of the super-rich, and having the majority of your potential market kept out due to income disparity is going to hurt in the long run. Also, the way many in the US have been able to increase their standard of living is increasing their debt, and that won't work indefinitely as well.

Unless there is a significant change in policy about taxation, and one that is the exact opposite of libertarians and Tea Party activists, the middle class and poor are only going to get squeezed more and more. But I have great difficulty fathoming how 80% of the nation can get less well off and think tax breaks for those outside above their income bracket will be their salvation. It hasn't worked now from 30 years. What's it going to take?

No comments:

Post a Comment